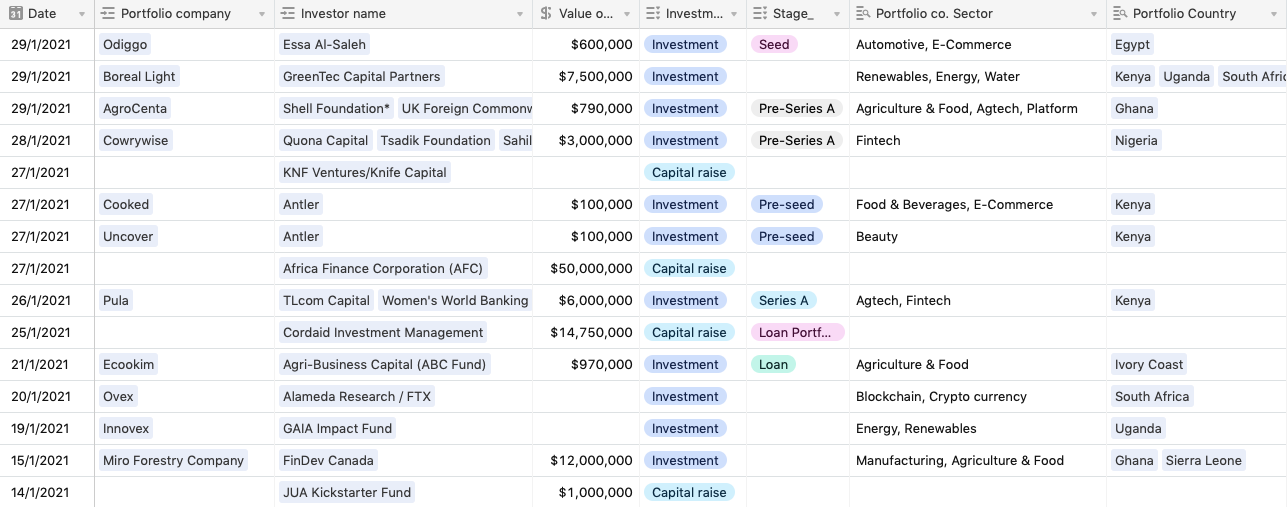

Hi and welcome to African VC/ Startup news, a weekly newsletter where I highlight transactions in the African startup ecosystem over the past week (or two). Since 14 January 2021, I noticed 15 deals come across my screen.

In addition to sending the weekly newsletter, I maintain a database of deals, investors and portfolio companies in the African startup ecosystem, it is available: here

Recently, I started a podcast with Kamo Motaung called The UpStartVC Podcast. It is available on Substack, Apple Podcast and Spotify, check it out and leave us a review!

Since 14 January 2021 I’ve noticed the following deals:

Investments (11 deals)

1: Miro Forestry Company | $12m | Undisclosed round | FinDev Canada | Agriculture

Investee:

Miro Forestry Company – a sustainable forestry and timber business with plantations in Ghana and Sierra Leone, West Africa. The company was founded, and began planting, in late 2010. It now has 9,800 hectares of standing forest established through its own planting activities.

Investors:

FinDev Canada – a Canadian Development Finance Institution (DFI) that offers financial solutions to businesses in developing countries, with the potential to develop markets, empower women and mitigate climate change.

Detail: $12m raised in an Undisclosed funding round. The financing will enable the firm to expand its forest plantations and industrial wood processing operations, which in turn will promote job creation and local community development.

2: Boreal Light | $7.5m | Undisclosed round | GreenTec Capital Partners | Renewables, Water

Investee:

Boreal Light – a German company that designs and manufactures affordable solar water desalination systems for off-grid communities around the globe.

Investors:

GreenTec Capital Partners – a long-term investor with headquarters in Germany that invests in African start-ups and SMEs with a focus on combining social and environmental impact with financial success.

Detail: $7.5m raised in an Undisclosed funding round. The funding will be used for their “scaleup” phase. They have already established a network of retail WaterKiosks in Kenya, delivered projects in Yemen, Somaliland, and Uganda and established a presence in South Africa.

3: Pula | $6m | Series A | TLcom Capital, Women’s World Banking | Fintech, Agtech

Investee:

Pula – radically restructures insurance, using technology and parametric insurance to insure the previously unbanked, uninsured, untapped market of 1.5 billion smallholders worldwide. They offer products in African countries such as Senegal, Mali, Nigeria, Ethiopia, Kenya, Rwanda, Uganda, Tanzania, Malawi, Zambia, and Mozambique.

Investors:

TLcom Capital – currently investing from its Tide Africa Fund, which invests in early to growth stage companies in Sub-Saharan Africa. They support entrepreneurs who are building fast-growth tech-enabled businesses solving complex challenges on the continent, investing between $500k and $10m.

Women's World Banking – designs and invests in the financial solutions, institutions and policy environments in emerging markets to create greater economic stability and prosperity for women, their families, and their communities.

Detail: $6m raised in a Series A funding round. The funding will be used to scale up operations in the company’s existing 13 markets across Africa.

4: Cowrywise | $3m | Pre-Series A | Quona Capital | Fintech

Investee:

Cowrywise – a Nigeria based fintech company digitizing the investment management industry in Africa and democratizing access to savings and investment products.

Investors:

Quona Capital – a venture capital firm that invests in growth-stage financial technology companies in emerging markets.

Tsadik Foundation – a family philanthropy inspired by the ideal of social justice, supporting organizations that provide direct benefits to disadvantaged communities worldwide.

Sahil Lavingia – the creator of Gumroad and a US based angel investor.

Detail: $3m raised in a Pre-Series A funding round. The capital will be used to grow its product offering and investment management infrastructure.

5: Ecookim | $970k | Loan | ABC Fund | Agriculture

Investee:

Ecookim – is the union of several leading cooperatives in the coffee-cocoa sector in the Ivory Coast. Ecookim’s members have a total cocoa production capacity of over 62,000 tons.

Investors:

Agri-Business Capital (ABC Fund) – a blended-finance impact fund which provides catalytic financing to underserved yet profitable segments of agribusiness value chains in developing countries.

Detail: $970k (EUR800k) loan to Ecookim. The loan allows funding to be provided to smallholder farmers at an earlier stage and at lower rates than local banks.

6: AgroCenta | $790k | Pre-Series A | Shell Foundation, FCDO, AV Ventures, Rabo Foundation | Agtech, Platform

Investee:

AgroCenta – a Ghana based online platform that connects stakeholders in the staple-food value-chain from smallholder farmers, partners, logistics suppliers, off-loaders to buyers under one umbrella for effective trading.

Investors:

Shell Foundation – a UK-registered charity, founded by Shell in 2000, that creates and scales business solutions to enhance access to energy and affordable transport.

UK’s Foreign, Commonwealth and Development Office (FCDO) – leads the UK’s work to end extreme poverty, tackling global challenges including poverty and disease, mass migration, insecurity and conflict.

AV Ventures – an impact investing subsidiary of ACDI/VOCA, dedicated to providing innovative, catalytic financing to small and medium enterprises (SMEs) in West Africa and Central Asia.

Rabo Foundation – an impact investment fund, founded by Rabobank in 1974, investing in self-sufficiency of farmer organizations in 22 countries in Africa, Asia and Latin America.

Detail: $790k raised in a Pre-Series A funding round. The capital will be used to develop smallholder farmer inclusion programmes and procure crops at transparent and fair market prices to service offtake contracts.

7: Odiggo | $600k | Seed | Essa Al-Saleh | Automotive, E-Commerce

Investee:

Odiggo – an Egyptian startup in the automotive industry that provides an online platform linking customers with already established car parts and accessories vendors.

Investors:

Essa Al-Saleh – an angel investor currently the chairman Volta Trucks.

Detail: $600k raised in a Seed funding round. The funding will be used to expand into new cities in Egypt and the region, and improve ease of access for users.

8: Cooked | $100k | Pre-Seed | Antler | Food & Beverages, E-Commerce

Investee:

Cooked – a Kenyan startup that delivers fresh ingredients with easy to follow recipes, straight to your door, making it simple to cook a healthy, tasty meal at home.

Investors:

Antler – a global early-stage venture capital firm that invests in technology companies of tomorrow.

Detail: $100k raised in a Pre-Seed funding round from the Antler 6-month startup generator program in Nairobi.

9: Uncover | $100k | Pre-Seed | Antler | Beauty

Investee:

Uncover – a Kenyan startup that helps you “uncover your most nourished, beautiful skin” sharing skincare must-haves.

Investors:

Antler

Detail: $100k raised in a Pre-Seed funding round from the Antler 6-month startup generator program in Nairobi.

10: Innovex | Undisclosed amount | Seed | GAIA Impact Fund | Energy, Renewables

Investee:

Innovex – a Uganda-based startup enabling pay-as-you-go and remote monitoring for solar companies.

Investors:

GAIA Impact Fund – a French impact fund dedicated to energy access, investing in startups and SMEs operating in Sub-Saharan Africa and South-East Asia.

Detail: Undisclosed amount invested in a Seed funding round. The capital will be used to scale their Remot product to 100 solar distributors across Africa.

11: Ovex | Undisclosed amount | Undisclosed round | Alameda Research | Cryptocurrency

Investee:

Ovex – a South African digital asset exchange and OTC trading desk, that brings liquidity to African cryptocurrency markets.

Investors:

Alameda Research – developer of FTX, the 5th largest crypto derivatives exchange in the world by trading volume.

Detail: Undisclosed amount invested in an Undisclosed funding round. The investment appears to be a strategic transaction for Alameda Research.

Fundraises (4 deals)

1: Africa Finance Corporation (AFC) | $50m | OPEC Fund for International Development

Investor: Africa Finance Corporation (AFC) – established in 2007 as an investment-grade multilateral finance institution with an equity capital base of US$1 billion to be the catalyst for private sector-led infrastructure investment across Africa.

Capital raised: $50m loan from the OPEC Fund for International Development.

Sector/ stage focus: Infrastructure.

Cheque size: Undisclosed.

2: Cordaid Investment Management | $14.75m | DFC

Investor: Cordaid Investment Management (CIM) – A debt investor in fragile markets for job creation, sustainable economic development and building resilient communities. CIM offers patient capital to small and medium enterprises with potential to grow but lacking access to finance.

Capital raised: $14.75m loan guarantee from the U.S. International Development Finance Corporation (DFC).

Sector/ stage focus: lending to small and medium enterprises (SMEs) in West Africa.

Portfolio size: targeting to lend $37m to 50 SMEs and 8 microfinance institutions.

Cheque size: Undisclosed.

3: JUA Kickstarter Fund | $1m | Simba Global Startups

Investor: JUA Kickstarter Fund – an African initiative with a Pan-African focus. Its intention is to help Africa achieve her potential – by helping entrepreneurs who need assistance to realise their dreams.

Capital raised: $1m from Simba Global Startups.

Sector/ stage focus: Entrepreneurs from across Africa or those who operate in Africa.

Portfolio size: $2m

Cheque size: between $50k and $250k.

4: Knife Capital / KNF Ventures II | Undisclosed amount | Undisclosed LPs

Investor: Knife Capital – an independent growth equity investment firm focusing on innovation-driven ventures with proven traction.

Capital raised: Undisclosed.

Sector/ stage focus: Growth equity for innovative startups.

Cheque size: Undisclosed.

Screenshot of deals since 14 January 2021:

Have a great week!

Daryn

African VC deals since 14 January 2021