Hi and welcome to African VC/ Startup news, a weekly newsletter where I highlight transactions in the African startup ecosystem over the past week (or two). Since 12 February 2021, I noticed 9 deals come across my screen.

In addition to sending the weekly newsletter, I maintain a database of deals, investors and portfolio companies in the African startup ecosystem, it is available: here

Recently, I started a podcast with Kamo Motaung called The UpStartVC Podcast. It is available on Substack, Apple Podcast and Spotify, check it out and leave us a review!

Since 9 February 2021 I noticed the following deals:

Investments (7 deals)

1: Amitruck | Undisclosed amount | Pre-Seed | Dynamo Ventures; Plug and Play Ventures | Logistics

Investee:

Amitruck – a Kenyan logistics start-up company that matches cargo owners with trucking logistics professionals through a digital competitive bidding process. Amitruck’s solution cuts out expensive middlemen whilst increasing security as all drivers and vehicles are vetted and goods in transit insured.

Investor(s):

Dynamo Ventures – a US-based venture capital firm that invests in supply chain and mobility, focused on pre-seed and seed-stage opportunities.

Plug and Play Ventures - a seed and early-stage venture capital firm focused on investing in emerging growth companies.

Detail: Kenyan logistics start-up Amitrucks has raised an undisclosed amount of pre-seed funding. The funds are to be used to expand the company’s reach across East Africa.

2: VeggieVictory | Undisclosed amount | Pre-Seed | Sustainable Food Ventures and others | Food & Beverages

Investee:

VeggieVictory – a Nigerian food technology company that develops healthy meat-alternatives that are affordable and are produced in Lagos.

Investor(s):

Sustainable Food Ventures – a US based venture capital firm that supports early stage founders developing sustainable food products in the global retail market. The company backs founders building leading food companies that are plant-based, cell-based or recombinant.

Capital V - a specialized private venture partner primarily providing Angel, Seed, and Series A funding. The company invests in solutions that facilitate sustained behavioural change and eliminates the consumption of animal products.

Kale United - a Swedish investment holding company investing in solutions that facilitate sustained behavioural change and eliminates the consumption of animal products.

Thrive Worldwide - a venture capital firm that invests in food techs, cryptocurrency, decentralized finance solutions, clean energy, and health therapies.

Detail: Nigeria’s first plant-based startup VeggieVictory has raised an undisclosed amount of pre-seed funding. The funds are to be used for product development for meat alternative solutions.

3: gnuGrid | $50k | Seed | Undisclosed US investors | Renewables

Investee:

gnuGrid – a Ugandan clean-tech social-enterprise that aims to foster energy inclusion in the country’s off-grid population. The company does this through the use of data to de-risk investment in off-grid and on-grid renewables for financial institutions. They provide the technology platform called SolarSentra, a consolidated product that combines pay-as-you-go technology, linkage to credit bureau ratings and CRM platforms.

Investor(s):

Undisclosed

Detail: Energy tech Ugandan company gnuGrid has received $50k seed round funding and will use these funds to expand its customer base and connect off-grid solar companies with Uganda’s Credit Reference Bureau.

4: SunCulture | $11m | Debt | Various | Renewables

Investee:

SunCulture – a company based in Nairobi, Kenya which sells the AgroSolar Irrigation Kit, an entirely solar-powered drip irrigation system. The kit combines solar water pumping technology with high-efficiency drip irrigation and includes everything a farmer needs to grow more while spending less, in a sustainable and energy-efficient way.

Investor(s):

SunFunder – a solar energy finance business with a mission to provide financing for solar assets in emerging economies, including inventory, working capital, construction, and structured finance loans.

Nordic Development Fund - NDF is the joint development finance institution of the Nordic countries - Denmark, Finland, Iceland, Norway and Sweden - that finances projects in cooperation with other development institutions. The fund provides capital for climate change interventions in low-income countries.

Triodos Investment Management - an investment manager that focuses on investments in various areas, including renewable energy, microfinance, and real estate.

Alpha Mundi - a commercial entity based in Switzerland and exclusively dedicated to Impact Investing. The fund provides debt and equity financing to scalable social ventures in strategic sustainable human development sectors such as microfinance, affordable education, fair trade agriculture and renewable energy.

Lion’s Head Global Partners - an Investment Bank operating across frontier and emerging markets globally with two principal subsidiaries: LHGP Asset Management, which carries out Investment Management activities, and Lion’s Head Global Partners, which focuses on financial advisory and capital raising.

Detail: Kenyan based renewable energy firm SunCulture has received an $11m syndicated loan. The funds will be used for expansion on the African continent.

5: Energy Vision | Undisclosed amount | Undisclosed round | Metier Sustainable Capital Fund | Renewable Energy

Investee:

Energy Vision – Gabon based telecom-focused Energy Service Company (ESCO), led by a team of experienced telecom and telecom infrastructure professionals, focused on emerging markets, mainly Africa.

Investor(s):

Metier Sustainable Capital Fund II – a private equity fund investing in clean energy generating assets and resource efficiency projects and businesses across Africa. The fund is managed by Metier Private Equity.

Detail: Energy service company Energy Vision has received an undisclosed amount of funding from the Metier Sustainable Capital Fund II, which it will use to increase its portfolio of installed non-carbon based power generation.

6: Connected Analytics | Undisclosed amount | Pre-Series A | Various | Retail-tech

Investee:

Connected Analytics – a Nigerian company that created ThankUCash, a multi-merchant rewards platform that works both offline and online. The scheme engages and rewards customers of ThankUCash partner retailers and creates growth opportunities for businesses under the ThankUCash brand.

Investor(s):

Betatron Venture Group – a Hong King based network of Investors, Entrepreneurs, Startups, Mentors, and Alumnus; focused on empowering founders. Through our platform, we provide funding, hands-on support, and unprecedented network access to drive business outcomes

Global Accelerex - a financial technology company focused on delivering digital payment solutions and services to customers across various industries in developing economies of the sub-Saharan African region.

Predictive VC - a US based venture capital firm that builds and invests in bold products harnessing data science for outsized impact. The firm develops and partners with impactful software platforms to accelerate value creation.

Detail: Nigeria’s Connected Analytics has raised a seven digit Pre-Series A funding round lead by Hong-Kong based Betatron Ventures Group. The funding will be used for hiring a quality team and improving the company’s technology.

7: Si-Ware Systems | $9m | Undisclosed round | Sawari Ventures; Egypt Ventures | Deeptech

Investee:

Si-Ware Solutions – an independent fabless semiconductor company, based in Egypt, that is fostering silicon innovation with a wide spectrum of product design and development solutions, custom ASIC development and supply, as well as standard products.

Investor(s):

Sawari Ventures – An international venture capital firm, that invests in people turning visionary ideas into market-leading companies in the MENA region.

Egypt Ventures - an investment firm focused on empowering the entrepreneurial ecosystem by investing in accelerators and co-investing in high-growth enterprises, with the mandate of catalysing investments in startups and high-growth potential businesses.

Detail: Egyptian electronics startup Si-Wares has raised $9m in an undisclosed funding round with a group of investors led by Sawari Ventures. The use of the funds has not been disclosed.

Fund raises (2 deals)

1: Uncovered Fund Inc. | $15m | African tech start-up investments

Investor: Uncovered Fund Inc. – a Japanese venture capital firm looking to create new industries on the African continent by investing in innovative start-ups and supporting business growth.

Capital raised: $15m (expected to close in June 2021)

Sector / Stage focus: African seed and early stage investments in the retail, fintech, e-health, logistics, MaaS, agri-tech, and smart city spaces.

Portfolio / fund size: targeting $15m

Cheque size: $50k to $500k

2: Capria Ventures | Undisclosed amount | Small Foundation | Hybrid Debt Facility

Investor: Capria Ventures – a leading global impact investment firm that works with local fund managers in emerging markets across Africa, Asia and Latin America, to accelerate the flow of global and local capital to high-growth businesses.

Capital raised: undisclosed

Sector / Stage focus: African focused investments into or along-side local partner investment managers.

Portfolio / fund size: undisclosed

Cheque size: undisclosed

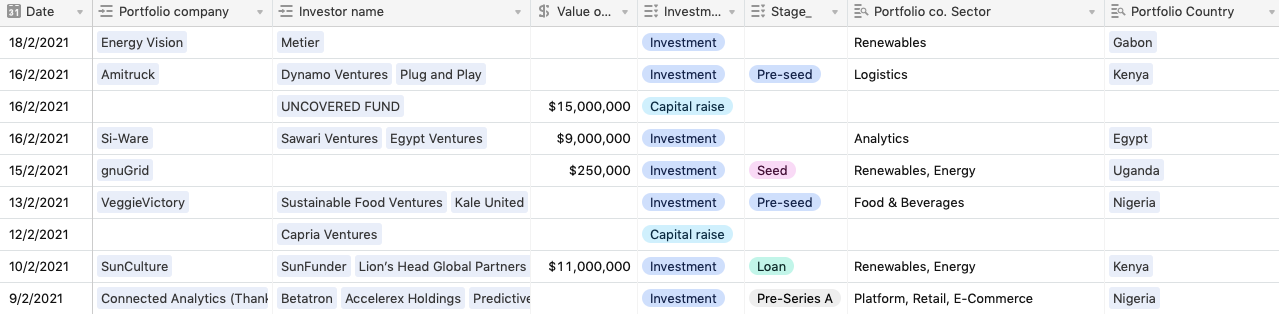

Screenshot of database since 9 February 2021:

Have a great week!

Daryn

Share this post