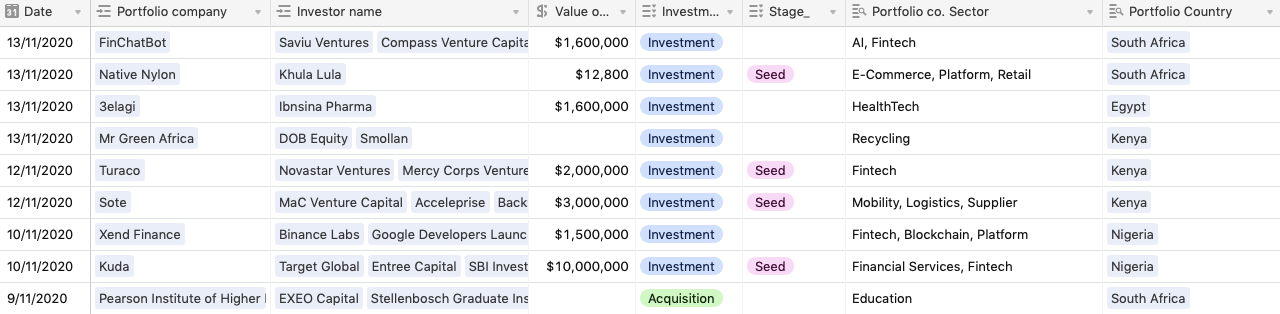

African VC deals since 1 November 2020

Hi and welcome to African VC/ Startup news, a weekly newsletter where I highlight transactions in the African startup ecosystem over the past week (or two). This week I saw 9 deals come across my screen.

In addition to sending the weekly newsletter, I maintain a database of deals, investors and portfolio companies in the African startup ecosystem, it is available: here

On Thursday, I started a podcast and released the introductory episode, the podcast can be played in your browser (if you click on the link in the email) and is also available on Spotify and Apple podcasts, I would love to hear your thoughts and suggestions for the podcast!

Update: since 1 November 2020 I have come across the following deals:

A consortium of Stellenbosch Graduate Institute (SGI) and EXEO Capital acquired the Pearson Institute of Higher Education South Africa (PIHE) from Pearson Plc. PIHE is one of the largest private education institutions in South Africa with 12 campuses, while SGI is a specialist provider of online higher education and is the education operating partner of EXEO Capital. EXEO Capital is a pan-African alternative investment firm with approximately $250m assets under management.

Kuda, the Nigerian digital-bank has raised $10m in a seed round (according to TechCrunch it is the largest seed round raised in Africa so far). Investors include the European VC, Target Global, Entrée Capital, SBI Investment and a number of angel investors.

Xend Finance another Nigerian Fintech company raised $1.5m from Binance Labs, Google Developers Launchpad, AU21 Capital, Amplifi VC, JUN Capital, TRG Capital, and angel investor Sandeep Nailwal. Xend Finance has developed the first decentralized finance (DeFi) platform, providing a location-agnostic protocol that can be accessed from anywhere in the world. Their product also allows users to create their own credit unions and cooperatives, and eliminate traditional middle-men.

Sote, a logistics software provider based in Kenya, has raised $3m in financing from MaC Venture Capital, Acceleprise, Backstage Capital and Future Africa. According to TechCrunch, Sote’s software can, “serve as a workflow tool to manage freight clearing and forwarding as well as a dashboard to track shipment status, payment history and the estimated arrival time for containers.”

Turaco, a Kenyan insurtech startup, received $2m in seed-round financing from Novastar Ventures, Mercy Corps Ventures, Musha Ventures, GAN Ventures, Zephyr Acorn and angel investors. The startup is operational in Kenya and Uganda and offers cost-effective health and life insurance products.

DOB Equity, the Dutch impact investor, and Smollan a company that provides retailers with advisory, marketing and consulting services, invested an undisclosed amount of capital in a Kenyan firm, Mr Green Africa. Mr Green Africa recycles plastic for numerous local and multinational manufacturers. The capital will be used to pilot a consumer facing app to trace the entire plastic life cycle.

In Egypt, Ibnsina Pharma, a pharmaceutical distributor, invested $1.6m in 3elagi Tech for a 75% stake of the startup. 3elagi Tech allows customers to order beauty and health products from pharmacies using their smartphones.

Khula Lula, a South African black-female-founded micro-VC fund, invested $12800 (R200k) in Native Nylon an upcoming fashion eCommerce startup.

FinChatBot, a South African fintech startup, raised $1.6m from Saviu Ventures (a French investment holding company), Compass Venture Capital (a venture capital fund of ENL Group) and Kalon Venture Partners (a South African VC fund). According to their website, FinChatBot, “creates Conversational AI Solutions for the Financial Services Industry.”

Screenshot from database - Deals since 25 October:

Have a great week!

Daryn